Maximize Club Vistara : A detailed guide

Vistara has the by far the most rewarding frequent flyer program in India, with great co-branded cards. This post listsf steps towards maximizing the value you can get with Vistara

Please see the destinations page to see if Vistara works for you

Club Vistara membership

The membership is free to sign up. Don’t miss out on this one - you get 500 points on signing up, and a minimum of 8% points on every Vistara ticket

-

Toggle to see detailed Club Vistara tier benefits

Tier Basic Silver Gold Platinum Rewards per Rs 100 8 9 10 11 Excess baggage 0 0 1 1 Upgrade vouchers / yr 0 1 3 5 Priority checkin, boarding, baggage - - Priority Priority

Co-branded credit cards

Vistara has co-branded credit cards with Axis, SBI and IndusInd banks. The main benefits from the cards are:

- Free flight ticket vouchers on signing up, and hitting milestones

- Club Vistara membership and tier upgrades

| Card | CV Tier | Joining / Renewal Fees | Points /₹200 | Ticket | Milestones |

|---|---|---|---|---|---|

| CV SBI | Basic | ₹1500 / ₹1500 | 3 | ECONOMY | ₹1.25L,₹2.5L,₹5L |

| Axis Vistara | Basic | ₹1500 / ₹1500 | 2 | ECONOMY | ₹1.25L,₹2.5L,₹6L |

| CV SBI Card PRIME | Silver | ₹3000 / ₹3000 | 4 | PREMIUM | ₹1.5L,₹3L,₹4.5L,₹8L |

| Axis Vistara Signature | Silver | ₹3000 / ₹3000 | 4 | PREMIUM | ₹1.5L,₹3L,₹4.5L,₹9L |

| Axis Vistara Infinite | Gold | ₹10000 / ₹10000 | 6 | BUSINESS | ₹2.5L,₹5L,₹7.5L,₹12L |

| IndusInd Bank Explorer | Gold for 1st year | ₹40000 / ₹10000 | 8 - Vistara, 6 - Hotel / travel. 2/1 - others | BUSINESS ( 1st yr only ) | ₹3L,₹6L,₹9L,₹12L,₹15L |

Cards have offers for bonus CV points for spend milestones in 90 days in the first year. There are a few more benefits, that I have left out. In my personal opinion, Economy vs Premium doesn’t make a big difference on lower durations. Further, the high joining fee for IndusInd does not justify the returns in my opinion.

Taking these into account, below is a comparative analysis of the different co-branded cards (skipping IndusInd Explorer). For the analysis, we make the following assumptions:

- Value of 1 CV Point = ₹1. Upgrade voucher = ₹1000. GST of 18%

- 1 economy/premium ticket = ₹5000, 1 business ticket = ₹6000. You may value it higher, but I don’t think its worth it

The chart below shows the rewards vs spends - the joining/renewal fees are accounted

From the chart, we can get the following inferences:

- CV SBI / Axis Vistara give the best net returns until a spend of ₹3L, followed by CV SBI Premium / Axis Vistara Premium until spends of ₹7.5L

- I also hold Axis Vistara Infinite - largely for priority checkin, boarding and baggage - I personally find it valuable

Co-branded card spending strategy

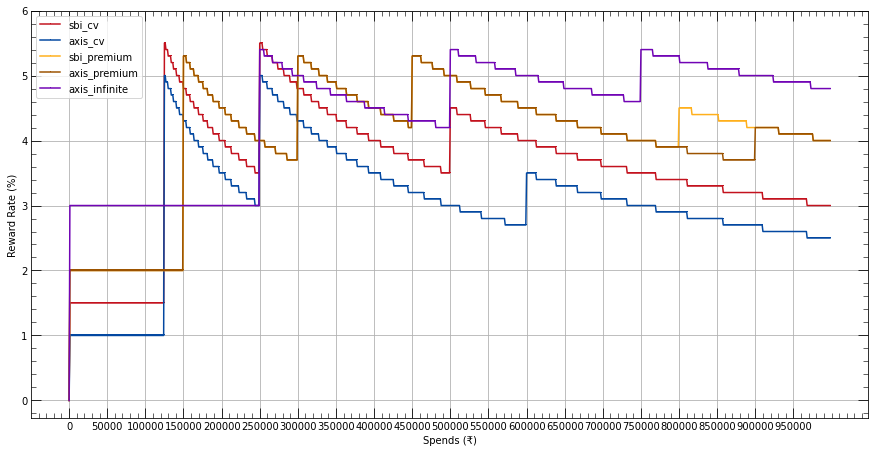

Looking at the strict reward rate (not taking joining fees, joining bonus and upgrade vouchers into account) below:

The 5.x % reward rates at milestones is better than what one can earn on most cards for general spends. This makes for a compelling case for using the CV cards as the default credit card for all spends except where multiplier offers give a better return. These multiplier offers form the final piece of the reward point jigsaw and are discussed in the next section. My personal recommendation would be to get a basic SBI ClubVistara card for the insane rewards, and the Axis Vistara Infinite card for Vistara gold benefits

Multiplier Cards for Club Vistara

This section gathers together some great offers on other cards for specific spends, which can give a huge number of CV points in return. It is important here not to spend for the sake of spending 🙂

Axis Bank Atlas

Atlas has a base reward rate of 4 CV points for every ₹100 spend, and 10CV points for every ₹100 spent on travel (flights and hotels) on Axis Bank’s portal. The CV account further adds on 8 - 11 CV points (depending on tier) if the card is used to book a Vistara flight: giving a net 18 - 21 CV points on Vistara, and 10CV points for other airlines/hotels. Further, for a joining fee of ₹5000, 10000 (minimum 5000 from year 2) CV points are obtained as a welcome bonus, so it makes sense to get this card just for the first year bonus.

Axis Bank Magnus

Atlas has a base reward rate of 4.8 CV points for every ₹100 spend, and 24CV points for every ₹100 spent on travel (flights and hotels) on Axis Bank’s portal, giving an insane 32-35CV per ₹100 spent on Vistara flights, and 24CV per ₹100 on hotels and other airlines. Further, Axis edge portal can have some great multiplier deals upto 8000 CV points per month, and the gift-edge portal may be used to purchase vouchers at 5X and 10X points - including vouchers from AmazonPay etc. On top of this, hitting a monthly spend of ₹100000 will net you 20000 CV miles on top of everything else, so if you’re anticipating a month with high spendings, Magnus should become the default card for all purchases hands down!

HDFC Infinia and Diners Black

Both of these currently have a base reward rate of 3.33 points (1 HDFC point converts to 1 CV point) for every ₹100 spend, and 20 points for every ₹100 spent on travel. HDFC SmartBuy also has some nice deals on railway tickets (10CV points per ₹100), and gift vouchers (17.5 CV for Infinia, 10CV for Diners - for ₹100 spends). These can be a great complement to the Axis cards - SmartBuy points give you the flexibility to redeem on all airlines

Overall, I will recommend going for all of these - they can take your miles game to an insane new level. Infinia is generally hard to get, and Atlas may be used for the first year if you get a Magnus too